Are you dreaming of opening your own restaurant, but struggling to secure funding due to bad credit? Don’t lose hope! In this article, we will explore the world of bad credit loans for restaurant startups.

Discover how to navigate the complexities of credit scores, find the right lender, and even improve your credit before applying. With the right knowledge and determination, you can overcome any financial obstacles and make your restaurant dreams a reality.

Four Takeaways

- Review credit report for errors or discrepancies and dispute them if necessary

- Pay bills on time and maintain low credit utilization to improve credit score

- Understand the impact of bad credit on restaurant funding and the limitations it may impose

- Research and compare different types of bad credit loans to find the best fit for your restaurant startup business needs

Understanding Bad Credit Loans

If you’re a restaurant owner with bad credit, understanding the ins and outs of bad credit startup loans is crucial. To improve your chances of securing a loan, it’s important to focus on credit repair techniques and understand the factors that affect your credit score.

Start by reviewing your credit report and identifying any errors or discrepancies that may be dragging your score down. Dispute these errors and work with credit bureaus to have them corrected.

Additionally, make sure to pay your bills on time and keep your credit utilization low. Lenders will also consider your business’s financials, such as revenue and cash flow, so it’s important to have accurate and up-to-date financial records.

The Importance of Credit Scores in Restaurant Funding

When it comes to restaurant funding, credit scores play a crucial role in determining eligibility and terms.

Lenders typically have credit score requirements that borrowers must meet in order to qualify for a loan.

A bad credit score can have a significant impact on your chances of securing funding, as it may lead to higher interest rates, stricter repayment terms, or even outright rejection.

Here are two statistics related to restaurant loans in 2019-2023:

1. Full-service restaurants received the highest volume of SBA small business loans, reaching 28,680 in 2019 alone, and limited-service restaurant businesses hold the #2 spot, with 19,141 loans distributed.

2. In 2022, the largest share of 7(a) loan dollars went to businesses in the accommodation and food services industry (19.20%), followed by retail trade (14%), and healthcare and social assistance (10.30%).

Credit Score Requirements

You need a good credit score to secure funding for your restaurant startup. Your credit score has a significant impact on your ability to obtain loans and financing for your business. Lenders use your credit score to assess your creditworthiness and determine the level of risk they are taking by lending to you. There are several factors that contribute to your credit score, including your payment history, credit utilization, length of credit history, and the types of credit you have. It is important to maintain a good credit score by paying your bills on time, keeping your credit utilization low, and avoiding excessive debt. By having a good credit score, you increase your chances of obtaining the necessary funding for your restaurant startup.

| Credit Score Factors | Description | Importance |

|---|---|---|

| Payment History | Your track record of paying bills on time | Very Important |

| Credit Utilization | The amount of credit you are using compared to your available credit | Important |

| Length of Credit History | The age of your credit accounts | Moderately Important |

Impact of Bad Credit?

Having bad credit can significantly hinder your chances of obtaining funding for your restaurant startup. Your credit score plays a crucial role in determining your eligibility for loans and other financing options. The impact of bad credit on your restaurant funding can be quite significant. Here are three ways in which your credit score can affect your ability to secure financing:

- Limited options: With a low credit score, you may have limited options when it comes to lenders and loan programs. This can make it difficult to find suitable financing for your restaurant startup.

- Higher interest rates: Lenders often charge higher interest rates to borrowers with bad credit. This means that even if you’re able to secure funding, you may end up paying more in interest over the life of the loan.

- Lower loan amounts: Lenders may be hesitant to provide large loan amounts to borrowers with bad credit. This can limit your ability to obtain the necessary capital to start or expand your restaurant business.

It is important to understand the impact of your credit score on financing options and take steps to improve it if necessary.

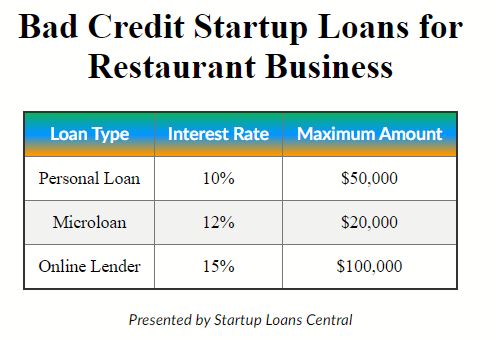

Different Types of Guaranteed Bad Credit Loans for Restaurant Startups

Consider three different types of bad credit loans available for restaurant startups. Despite having bad credit, there are lenders who are willing to provide financial assistance to help you get your restaurant business off the ground. Here are three types of bad credit loans that you can explore:

| Loan Type | Types of Lenders | Loan Terms |

|---|---|---|

| Business Line of Credit | Online lenders, credit unions, alternative lenders | Revolving credit line with flexible repayment terms |

| Equipment Financing | Equipment financing companies, online lenders | Loan secured by restaurant equipment with fixed monthly payments |

| Merchant Cash Advance | Merchant cash advance providers | Lump sum cash advance repaid through a portion of daily credit card sales |

Each type of loan offers different benefits and considerations, so it is important to carefully evaluate your options and choose the one that best fits your restaurant startup’s needs. Remember to review the loan terms, interest rates, and repayment terms before making a decision.

Finding the Right Lender for Your Restaurant Business

If you’re a restaurant business owner with bad credit, finding the right lender can be crucial to securing the financial assistance you need. While traditional banks may be hesitant to provide loans to individuals with bad credit, there are alternative lenders who specialize in working with businesses in similar situations.

Here are three advantages of bad credit loans that you should consider:

- Flexible approval process: Alternative lenders are often more lenient when it comes to credit score requirements, making it easier for restaurant owners with bad credit to get approved for a loan.

- Quick access to funds: Compared to traditional lenders, alternative lenders can provide faster approval and funding, allowing you to address any immediate financial needs for your restaurant.

- Opportunity to rebuild credit: By consistently making timely payments on your bad credit loan, you can gradually improve your credit score, making it easier to secure financing in the future.

Finding the right lender is essential for your restaurant business’s success, so take the time to research and compare options to find the best fit for your needs.

Steps to Improve Your Credit Before Applying for a Loan

Before applying for a loan, there are several steps you can take to improve your credit.

One strategy is to review your credit report for any errors and dispute them if necessary.

Additionally, paying off outstanding debts and making payments on time can greatly improve your creditworthiness.

Building a positive credit history and maintaining a low credit utilization ratio are also important factors in increasing your loan eligibility.

Credit Repair Strategies

Take immediate action to improve your credit score before applying for a loan to increase your chances of approval. Improving your creditworthiness is crucial in securing the financing you need for your restaurant startup. Here are some credit repair techniques that can help you on your journey:

- Pay your bills on time: Making timely payments shows lenders that you’re responsible and reliable.

- Reduce your credit utilization: Aim to keep your credit card balances below 30% of your available credit limit.

- Dispute errors on your credit report: Regularly review your credit report for inaccuracies and file disputes if necessary.

Loan Eligibility Requirements

To increase your chances of loan approval, ensure that you meet the eligibility requirements and take steps to improve your credit.

Before applying for a loan, it’s important to understand the loan application process and the loan repayment terms.

Lenders typically consider certain factors when determining loan eligibility, such as your credit score, income, and debt-to-income ratio.

It’s advisable to review your credit report and address any errors or negative items before applying for a loan. Paying off outstanding debts and making timely payments on your existing loans can help improve your credit score.

Additionally, reducing your debt-to-income ratio by increasing your income or reducing your expenses can also strengthen your loan application.

Building Creditworthiness Effectively

Are you aware of the steps you can take to effectively build creditworthiness before applying for a loan? Building and improving your creditworthiness is crucial when seeking a loan for your restaurant startup. Here are some credit building strategies to help you improve your credit before applying for a loan:

- Pay your bills on time: Consistently making timely payments shows lenders that you’re responsible and can be trusted with credit.

- Reduce your credit utilization: Keeping your credit card balances low, ideally below 30% of your available credit limit, demonstrates good financial management.

- Diversify your credit: Having a mix of credit types, such as credit cards, loans, and a mortgage, can positively impact your creditworthiness.

How to Create a Successful Restaurant Business Plan

You can start by outlining your restaurant’s vision and mission in your business plan. This is important because it sets the foundation for your restaurant’s identity and purpose.

In your business plan, you should also include details about your target market, competition analysis, and marketing strategies. Creating an effective business model is crucial to attract investors and funding.

You should outline your revenue streams, cost structure, and financial projections. Investors want to see a clear plan for how your restaurant will generate profits and sustain growth.

Additionally, it’s important to highlight any unique selling points or competitive advantages that will make your restaurant stand out.

Securing Collateral for Bad Credit Loans

When securing collateral for bad credit loans, it’s important to consider alternative options beyond traditional assets like real estate or vehicles. These alternative collateral options could include equipment, inventory, or even future revenue streams.

Lenders will assess the risk associated with the collateral provided, taking into account factors such as the value, marketability, and potential depreciation of the assets.

Alternative Collateral Options

If you’re looking to secure collateral for bad credit loans, there are alternative options available to you. While traditional collateral options like real estate or vehicles may not be feasible for someone with bad credit, there are other assets that can be used to secure a loan.

Here are three alternative collateral options that you can consider:

- Inventory: If you have valuable inventory for your restaurant business, you can use it as collateral. This shows lenders that you have assets that can be liquidated if needed.

- Equipment: Restaurant equipment, such as ovens, refrigerators, and industrial-sized mixers, can be used as collateral. This demonstrates to lenders that you have valuable assets that can be sold to repay the loan.

- Accounts Receivable: If you have outstanding invoices from customers, you can use them as collateral. This shows lenders that you have a steady stream of income and reduces their risk.

Risk Assessment for Lenders

Lenders assess the risk involved in securing collateral for bad credit loans to ensure their investment is protected. When considering lending to a borrower with bad credit, lenders conduct a thorough risk analysis to evaluate the borrower’s credibility and determine the likelihood of repayment. This assessment helps lenders gauge the level of risk they are taking on and determine the appropriate collateral required to mitigate that risk.

To assess borrower credibility, lenders typically consider factors such as credit history, income stability, and debt-to-income ratio. They also evaluate the borrower’s business plan and financial projections to assess the viability of the restaurant startup. Lenders may also request additional collateral such as personal assets or a personal guarantee from the borrower to further secure the loan.

In the table below, we outline some key factors that lenders consider when assessing borrower credibility for bad credit loans:

| Factors | Description |

|---|---|

| Credit History | Evaluating the borrower’s past credit behavior, including late payments, defaults, and bankruptcies. |

| Income Stability | Assessing the consistency and reliability of the borrower’s income sources. |

| Debt-to-Income Ratio | Analyzing the borrower’s debt obligations in relation to their income. |

| Business Viability | Evaluating the viability of the restaurant startup through a thorough review of the business plan and financial projections. |

| Additional Collateral | Requesting additional collateral, such as personal assets or a personal guarantee, to further secure the loan. |

Exploring Alternative Funding Options for Restaurant Startups

You should consider various alternative funding options for your restaurant startup. While bad credit loans may be an option, there are other avenues worth exploring. Here are three alternative funding options to consider:

- Crowdfunding: Engage with your community and potential customers by launching a crowdfunding campaign. This not only helps raise funds but also creates a sense of belonging and support from your local community.

- Angel Investors: Seek out individuals who are willing to invest in your restaurant startup in exchange for a percentage of ownership. This can provide not only financial support but also expertise and guidance.

- Small Business Grants: Explore grants specifically designed for small businesses in the restaurant industry. These grants can provide a significant amount of funding without the need for repayment.

By considering these alternative funding options, you can find the financial support you need to bring your restaurant startup to life.

Don’t forget to also explore credit repair strategies to improve your creditworthiness and increase your chances of securing funding.

Tips for Managing Finances and Repaying Bad Credit Loans

Consider implementing effective strategies to manage your finances and successfully repay bad credit loans.

When it comes to managing cash flow, it’s crucial to keep a close eye on your income and expenses. Start by creating a detailed budget that outlines your monthly revenue and fixed costs such as rent, utilities, and loan payments. This will help you identify areas where you can cut back or optimize spending.

Additionally, consider implementing budgeting techniques such as the 50/30/20 rule, where 50% of your income goes towards necessities, 30% towards wants, and 20% towards savings or debt repayment.

Another useful tip is to negotiate with suppliers and vendors for better pricing and payment terms.

Success Stories: Restaurants That Overcame Bad Credit and Thrived

Despite facing financial challenges, many restaurant owners have managed to overcome bad credit and achieve thriving businesses. These success stories serve as inspiration for aspiring restaurateurs who are struggling with their credit scores.

Here are some examples of restaurants that overcame their bad credit and turned their fortunes around:

- The Savory Spoon: Despite starting with a low credit score, the owners of The Savory Spoon managed to secure a small business loan and slowly rebuilt their credit over time. They learned the importance of budgeting, cutting unnecessary expenses, and negotiating with suppliers for better deals.

- Cafe Blossom: After facing bankruptcy, the owners of Cafe Blossom were determined to make a fresh start. They sought help from a credit repair agency, implemented strict financial management practices, and focused on building strong relationships with their customers. Through hard work and perseverance, they transformed their restaurant into a bustling hotspot.

- Taste of Success: This family-owned restaurant faced numerous obstacles due to bad credit. However, they never gave up and sought alternative funding options, such as crowdfunding and community support. They also learned the value of strategic marketing and customer satisfaction, which helped them create a loyal customer base.

These success stories highlight the importance of overcoming obstacles and the valuable lessons learned along the way.

Frequently Asked Questions for Restaurant Startup Bad Credit Loans

Can I Get a Bad Credit Loan for a Restaurant Startup Without Any Collateral?

Can you really get a bad credit loan for a restaurant startup without any collateral? Well, let’s take a closer look at restaurant startup financing and unsecured business loans to find out.

Is It Possible to Secure a Bad Credit Loan for a Restaurant Startup With a Low Credit Score?

It may be challenging to secure a bad credit loan for a restaurant startup with a low credit score. A low credit score can impact interest rates. Consider improving your credit score before applying.

What Are Some Alternative Funding Options for Restaurant Startups With Bad Credit?

If you have bad credit, there are alternative funding options available for restaurant startups. Look into creative financing solutions such as crowdfunding, personal savings, family and friends, or small business grants.

How Long Does It Typically Take to Improve a Credit Score Before Applying for a Bad Credit Loan?

Improving your credit score before applying for a bad credit loan can vary in time. Factors like payment history, credit utilization, and length of credit history affect the timeline. It’s essential to focus on consistent positive financial behaviors to see improvements.

Are There Any Specific Tips or Strategies for Managing Finances and Repaying Bad Credit Loans for Restaurant Startups?

To effectively manage finances and repay bad credit loans for restaurant startups, it is crucial to develop strategies for budgeting and building a strong credit history. Implementing these tactics will ensure financial stability and increase your chances of success.

Conclusion

In conclusion, while bad credit loans may be a viable option for restaurant startup businesses with less-than-perfect credit, it’s important to understand the implications and responsibilities that come with such loans.

By improving your credit score, exploring alternative funding options, and effectively managing finances, it’s possible to overcome bad credit and thrive in the restaurant industry.

Just like these successful restaurants, with determination and strategic planning, you too can achieve your entrepreneurial dreams.

0 Comments